- Pro

Scaling AI in financial services

When you purchase through links on our site, we may earn an affiliate commission. Here’s how it works.

Image credit: Shutterstock

(Image credit: Number1411 / Shutterstock)

Share

Share by:

Image credit: Shutterstock

(Image credit: Number1411 / Shutterstock)

Share

Share by:

- Copy link

- X

- Threads

Generative AI, and increasingly AI agents, are quickly taking center stage in financial services.

What was formerly limited to experimentation has since evolved into systems capable of data analysis, real life action and large-scale decision making.

Cyril CymblerSocial Links NavigationHead of Financial Services EMEA & Strategic Customers at Databricks.

Many businesses are already feeling the effects of this transformation; according to KPMG research, more than half (51%) of the financial sector say AI is reshaping their business. On the other hand, almost three-quarters (72%) are concerned about data quality.

You may like-

Cracking the AI code: realizing AI's true value in finance

Cracking the AI code: realizing AI's true value in finance

-

How big businesses are handling the roll out of Generative AI

How big businesses are handling the roll out of Generative AI

-

What technology leaders need to ensure AI delivers

What technology leaders need to ensure AI delivers

This is when strategic risk creeps in, stemming from fragmented or poorly governed data, that ultimately delays the transition from pilot to production.

Financial institutions must shift their focus if they want to see true value from AI. With solid data foundations that are backed by robust infrastructure and unified governance they will then be in a better position to implement AI safely and successfully.

The true challenge now is not what AI can accomplish, but rather how businesses can take the right steps to enable it to operate at enterprise level.

Building the foundations for enterprise-scale AI

Most AI pilots fail both because the data beneath them are fragmented, poor quality or locked away in silos and because their AI agents do not have a focus on measuring and improving quality and accuracy. In order to successfully deploy AI, the infrastructure must be set up correctly to harness results.

Are you a pro? Subscribe to our newsletterContact me with news and offers from other Future brandsReceive email from us on behalf of our trusted partners or sponsorsBy submitting your information you agree to the Terms & Conditions and Privacy Policy and are aged 16 or over.For leaders in the financial sector to close the AI adoption gap, a structured roadmap should be in place to enable their business to move from experimentation to scaled impact.

The first step is to unify data silos under a single platform to eliminate duplications, reduce inefficiencies and build reliable, trusted models from a single source of truth.

From there, governance must be embedded to manage lineage, access and audit trails. For AI agents, governance is far more than a mere compliance exercise. A unified governance model treats agents with the same rigor as human staff, applying robust access controls and security measures.

You may like-

Cracking the AI code: realizing AI's true value in finance

Cracking the AI code: realizing AI's true value in finance

-

How big businesses are handling the roll out of Generative AI

How big businesses are handling the roll out of Generative AI

-

What technology leaders need to ensure AI delivers

What technology leaders need to ensure AI delivers

Prioritizing explainability is equally crucial. In a highly regulated market, businesses need accessible, transparent models that demonstrate how results are produced.

Additionally, adopting a "start small, scale fast" strategy demonstrates impact early, fosters internal trust and establishes a replicable model for safely and responsibly expanding AI across the company.

Closing the gap between AI vision and execution

Leaders in the financial industry are no longer asking where AI works, but instead, where it can deliver the most impact. The potential is enormous, but the gap between ambition and execution is slow to close.

At present, hype is outpacing reality. A recent Gartner survey shows that finance AI adoption jumped from 37% in 2023 to 58% last year, however momentum is now slowing, showcasing the gap between experimentation and enterprise scale.

Despite varying regulatory environments, firms across banking, payments, capital markets and asset management align on the same strategic objectives driving AI adoption.

Businesses must acknowledge that to deliver these ambitions consistently at scale, the challenge is not in the vision, but in bringing together fragmented data assets and legacy infrastructure.

How AI delivers sustainable growth

The financial industry recognizes the value that AI technology can offer by boosting efficiency and driving growth, we can see that in the uptick of adoption of the technology.

Smarter customer segmentation and hyper-personalization allow enterprises to differentiate their brand and elevate customer experience, creating a significant advantage over their competitors.

In payments and mortgages for example, AI-powered product innovations such as real-time fraud prevention and property valuation models are transforming journeys and reshaping how institutions deliver their services.

However, implementing individual use cases is not enough to translate these skills into long-term revenue development; a clear business strategy is also necessary.

Financial organizations must prioritize use cases with quantifiable ROI, align AI operations to particular business goals, and make sure that data foundations enable models to be constantly refined.

How AI agents are redefining risk management

In financial services, risks can appear in minutes, from cyber threats to fraud disruption. The speed, complexity and sheer volume of these problems are too much for traditional manual methods to handle.

AI agents are quickly becoming the new competitive frontier to improve quality and accuracy. Unlike static models, these systems can act almost like virtual employees that take actions autonomously.

In mission-critical areas such as fraud detection, anti-money laundering (AML) and cybersecurity, agents monitor, orchestrate and conduct checks with far greater speed and reliability than manual teams.

Operating in one of the strictest regulatory industries, AI agents provide a means for organizations to keep ahead of the risks while preserving the integrity of key operations. Rather than replacing human judgement, AI agents enhance it; enabling teams to react with greater assurance.

Reimagining operations with AI

Advanced AI tools are changing the game for financial services, driving innovation and agility. AI agents can automate repetitive business processes allowing institutions to “do more with less”, reducing workloads which allow teams to focus on higher-value, customer orientated work.

AI-driven customer service assistants are also already delivering measurable impact. Trained on enterprises’ own data, they can answer questions accurately and automate much of the triage process. The results are fewer manual bottlenecks, elevated customer experiences and a more resilient operational model.

Building the future of financial services

The majority of financial organizations understand how and why AI will affect them in the future. However, trying to operationalize it in a way that is dependable, compliant, and long-lasting is less evident. Data architecture and governance must be seen as fundamental in a company’s data and AI strategy to achieve a competitive edge.

For AI agents to operate safely within rigorous boundaries, systems must be built with established controls and continuous monitoring. AI success will favor the institutions that adopt a disciplined approach and scale with confidence.

We've featured the best small business software.

This article was produced as part of TechRadarPro's Expert Insights channel where we feature the best and brightest minds in the technology industry today. The views expressed here are those of the author and are not necessarily those of TechRadarPro or Future plc. If you are interested in contributing find out more here: https://www.techradar.com/news/submit-your-story-to-techradar-pro

TOPICS AI Cyril CymblerSocial Links NavigationHead of Financial Services EMEA & Strategic Customers at Databricks.

Show More CommentsYou must confirm your public display name before commenting

Please logout and then login again, you will then be prompted to enter your display name.

Logout Read more Cracking the AI code: realizing AI's true value in finance

Cracking the AI code: realizing AI's true value in finance

How big businesses are handling the roll out of Generative AI

How big businesses are handling the roll out of Generative AI

What technology leaders need to ensure AI delivers

What technology leaders need to ensure AI delivers

Harmonizing AI innovation with cost, risk & ROI

Harmonizing AI innovation with cost, risk & ROI

How to build AI agents that don’t break at scale

How to build AI agents that don’t break at scale

Why agentic AI pilots stall – and how to fix them

Latest in Pro

Why agentic AI pilots stall – and how to fix them

Latest in Pro

Huge data leak of 149 million credentials exposed without any protection – 98GB of unique usernames and passwords from financial services, social media accounts and dating apps

Huge data leak of 149 million credentials exposed without any protection – 98GB of unique usernames and passwords from financial services, social media accounts and dating apps

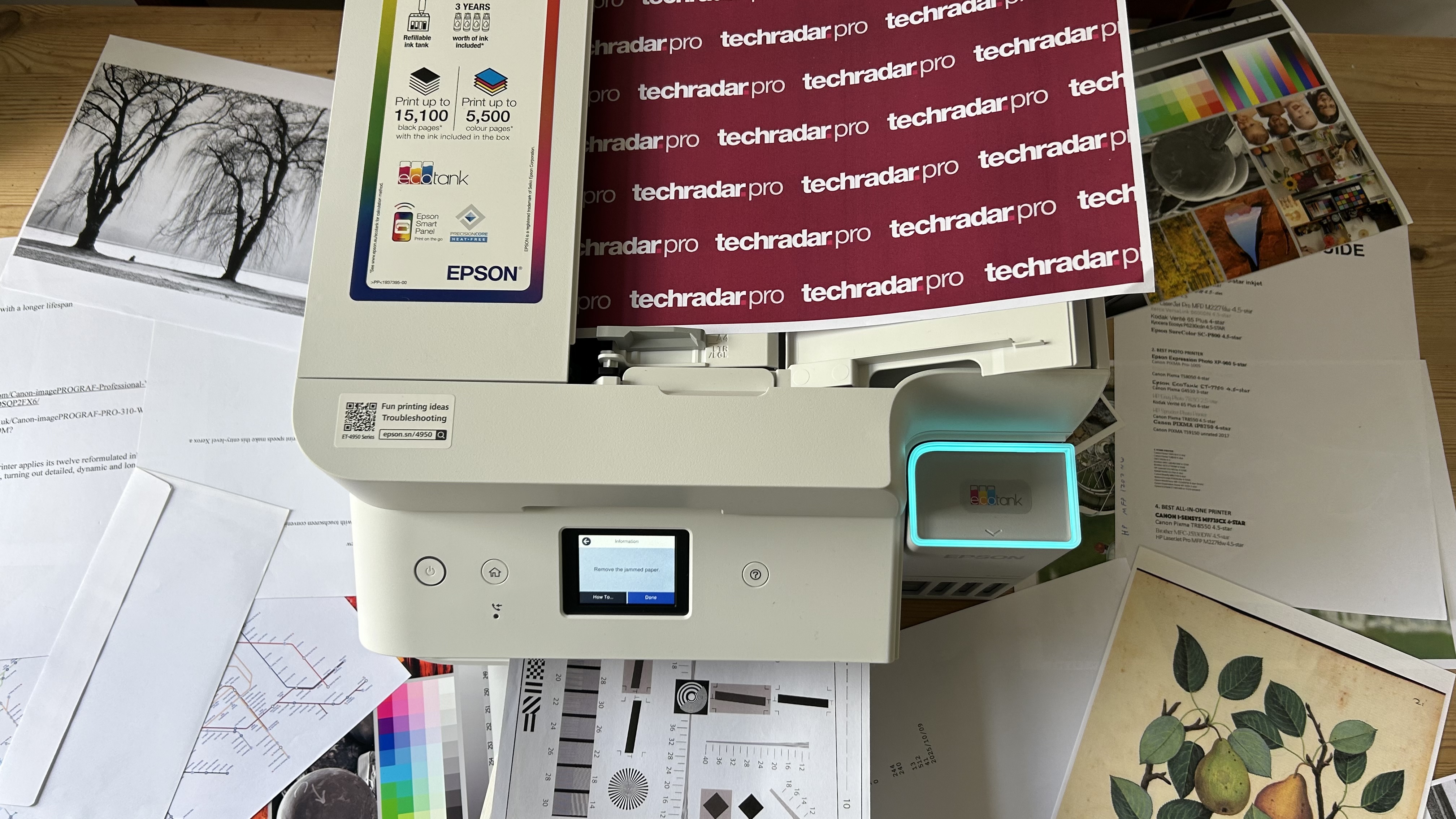

Epson EcoTank ET-4950 ink tank printer review

Epson EcoTank ET-4950 ink tank printer review

Crowdstrike and Nord Security partnership nests Falcon Go and Falcon Enterprise directly through NordLayer – combined enterprise-grade protection with VPN and ZTNA for SMBs

Crowdstrike and Nord Security partnership nests Falcon Go and Falcon Enterprise directly through NordLayer – combined enterprise-grade protection with VPN and ZTNA for SMBs

Cracking the AI code: realizing AI's true value in finance

Cracking the AI code: realizing AI's true value in finance

Microsoft SharePoint exploited to hack multiple energy firms

Microsoft SharePoint exploited to hack multiple energy firms

Curl will stop bug bounties program due to avalanche of AI slop

Latest in Opinion

Curl will stop bug bounties program due to avalanche of AI slop

Latest in Opinion

It might sound strange, but The Matrix is actually a happy movie — rewatch it to shake off the January blues

It might sound strange, but The Matrix is actually a happy movie — rewatch it to shake off the January blues

Dyson's biggest product innovations, ranked from game-changer to gimmick

Dyson's biggest product innovations, ranked from game-changer to gimmick

The ROI blueprint: turning AI and automation into business value

The ROI blueprint: turning AI and automation into business value

How CIOs can shift from patch and pray to risk-based software change

How CIOs can shift from patch and pray to risk-based software change

It’s not a bubble, we’re surfing the AI wave

It’s not a bubble, we’re surfing the AI wave

Report: Apple does about-face on Siri chatbot — and it might compete directly with ChatGPT and Google

LATEST ARTICLES

Report: Apple does about-face on Siri chatbot — and it might compete directly with ChatGPT and Google

LATEST ARTICLES- 1Russia’s battle against VPNs is entering a new phase: Here's what to expect in 2026

- 2ChatGPT has a hidden set of creativity switches — here’s how to use them

- 3It might sound strange, but The Matrix is actually a happy movie — rewatch it to shake off the January blues

- 4I tested Sigma's superb 17-40mm f/1.8 DC for a month – it's the ultimate zoom lens for APS-C cameras, and prime lens killer

- 5‘It’s theft – plain and simple’: hundreds of artists including Scarlett Johansson have snapped and made an anti-AI campaign that says ‘a better way exists’